It’s likely that an outsourced CFO has experienced these challenges before, making them well-qualified to advise your business on its strategic direction. It can be difficult to understand the benefits of partnering with an outsourced CFO before starting to work with one. Many times, businesses have all kinds of hidden opportunities hidden in their internal systems and accounts. It’s the job of the CFO to uncover these inefficiencies and implement strategic changes to remedy them. Because an outsourced bookkeeper isn’t immersed in your business the same way an internal employee would be, there may be some intricacies of your business that they don’t understand at first.

Ignite Spot Accounting: Best reporting

This is not a problem with outsourcing because it allows you to hire the best experts in the financial services industry from across the globe. These teams are also experienced when it comes to remote work and are dedicated to providing the same (or even more) value when compared to an in-house team. And since your team may be working from a different time zone, you may be able to extend your company’s operational hours and further boost your financial activities’ efficiency.

Disadvantages of Working With An Outsourced CFO

Our use of the terms “our Firm” and “we” and “us” and terms of similar import, denote the alternative practice structure of Cherry Bekaert LLP and Cherry Bekaert Advisory LLC. So you shouldn’t feel like you have to handle all the finances in your small business. You know, those times of the year when coffee becomes your best friend and the office practically turns..

Q: Are outsourced accounting services only available for specific industries?

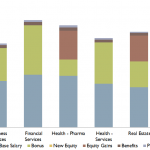

This collaboration allows current staff to work alongside specialists, gaining expertise in technical areas. The close association with an outsourcing partner provides valuable learning opportunities for the in-house team. To meet their needs, RSM provides outsourcing solutions that cost-effectively improve finance and accounting functions. We offer a suite of services that leverage leading technology platforms tailored to your own unique needs. Moving your company’s financial and accounting needs from the in-house department to an outsourced service can save thousands. You will no longer need to spend money on hiring, onboarding, or training costs as well as salary for those you hire; all these expenses are taken care of by professionals who know what they are doing.

You can outsource more complex functions such as financial analysis, forecasting, etc., rather than just basic bookkeeping. The F&A Industry has been steadily moving into the digital space, making keeping financial reports and books more accessible. Thanks in part due to integrated accounting platforms available on every device we carry with us 24/7, accountants can help update is it possible to lower my effective tax rate what are my options your books whenever a transaction or event occurs within their company. Advanced technology has made it possible for financial and accounting experts to create better and more accurate financial models than ever before. Without a timely and accurate cash flow forecast, your company may run into future problems and surprises, which is why financial modeling is so important.

Alternatively, the business can choose to outsource only certain complicated tasks while managing the rest internally. Some additional features come as an add-on while others might be included in the plan, making the service provider more appealing. Some additional features include integrations, management dashboard, overtime alerts, engagement tools, tax functionality, PTO tracking and live customer support. Some users may be looking for the best deal around for simple HR services such as payroll processing or administration, but some are willing to pay more for functionality, value, additional features and ease of use.

You can focus on growing your business and making data-driven decisions while your outsourced team handles your every accounting need. You won’t have the burden of finding staff or investing in training, so you’ll save time and money on this crucial aspect for yourself! Are you looking for complete financial service outsourcing, or do you need to outsource specific tasks? What kind of privacy or security measures does your business require (depending on the operations and data that you will share with the outsourced team)? Do you need to outsource common finance and accounting services, or do you need CFO consulting services?

But the majority of companies just want to meet their obligations with minimal fuss, and entrust the heavy lifting to trained experts. If you’re communicating clearly with a trustworthy partner, this doesn’t need to be a negative. Once you’ve signed an agreement, your service provider will need access to your https://www.accountingcoaching.online/can-you-add-money-to-a-cd-account/ data. Set up restricted user accounts, and only provide access to the systems and data that are needed for the provider to perform their tasks. Many companies outsource this task to experienced auditors, who can independently assess your company’s financial processes and even advise on ways to improve.

The work can be challenging, but it’s worth every second when you discover that someone has been committing these acts against your company. Tax accounting is the process of recording and summarizing financial information for tax purposes, which are governed by local regulations such as the Internal Revenue Code in the US. Those regulations dictate specific rules companies must follow when preparing their tax returns. Bookkeeping is an essential part of any company’s operation; without it, the finances could not be adequately monitored. Advanced technology has made it possible to create more accurate and timely financial models than ever before.

Your outsourcing provider can also help assess the best time to outsource your accounting services. With outsourced accounting services, you’ll have meticulous eyes that can process financial data while ruling out fraud simultaneously. The process of finding the right outsourcing finance and accounting services provider is not an easy task. However, take your time to consider what criteria will make a good fit for your company and your outsourced partner. It should become easier to decide where best suited with all things considered.

Making sense of your numbers can be time-consuming and frustrating, to say the least. It’s no wonder so many small business owners have turned to outsourced accounting services for relief. Outsourcing some or all of your accounting needs to an external third party can represent a major win for business owners. Aside from the cost savings, partnering with an outsourced accounting firm gives businesses access to proven finance professionals with the skills and resources required to take their business to the next level. Virtual and outsourced bookkeeping and accounting services are a happy medium between do-it-yourself software and pricey in-house bookkeeping.

- For the most part, these services are identical to outsourced accounting services, although it’s important to bear in mind that different providers will offer varying services.

- This knowledge is especially important in the current age, with most services and transactions occurring online.

- Outsourced accounting refers to the practice where a business engages a third-party entity external to its organization to manage various accounting and finance functions.

The third-party accounting company acts as an in-house accounting department and may provide extensive support, as well as offer more advanced services such as CFO and controllership advisory services. With our help, your business can streamline https://www.online-accounting.net/ accounting processes, increase productivity and make informed decisions based on reliable financial information. External accounting companies will have the most updated knowledge of security procedures and data protection standards.

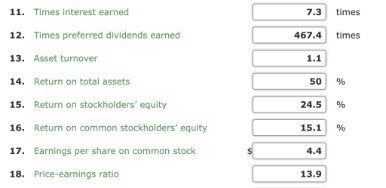

Whether it’s keeping track of every penny or untangling the web of tax compliance, these are not the waters you want to be navigating daily. Depending on your startup’s size, industry, and strategic objectives, you may choose to outsource some or all of the following services. We work as a natural extension of your internal accounting team by providing insights, streamlined accounting processes, and collaboration with your existing staff to help you reach your goals. Our reporting capabilities offer real-time visibility into your financial performance. We provide accurate and timely financial statements, KPIs, cash flow projections, and tailored critical metrics. Keen attention to detail and robust knowledge for managing donations, funding, auditing, and financial reporting obligations are crucial.

It’s important to find an outsourced bookkeeping partner that will invest the time required to truly get to know your business. You may think that outsourcing is only a practice for large, well-established businesses that offshore basic operations. But in reality, many businesses across the country, big and small, are embracing outsourced accounting. Among all these day-to-day activities, it can be difficult to find time for your accounting, even though you know how important it is to your business. Maintaining accurate, timely financial information is vital in enabling you to make better decisions for your business.